Today in Forex & Macro

The greenback sits in the driver's seat this Tuesday as traders brace for what could be a market-defining CPI print. With inflation expectations creeping higher and the Fed maintaining its hawkish posture, we're looking at potential fireworks across major pairs. Meanwhile, banking giants are set to spill their quarterly secrets before the opening bell—giving us fresh intel on how corporate America views the economic landscape ahead.

The dollar's showing modest strength against most majors, while European currencies remain under pressure amid ongoing uncertainty about ECB policy divergence. Oil's found some stability after Trump's latest Russia-Ukraine ultimatum, though geopolitical tensions continue simmering beneath the surface.

🃏 Volatility Mood

Medium intensity with potential for explosive moves post-CPI. Smart money's positioning defensively while retail chases momentum—classic setup for whipsaw action. Keep your risk tight today.

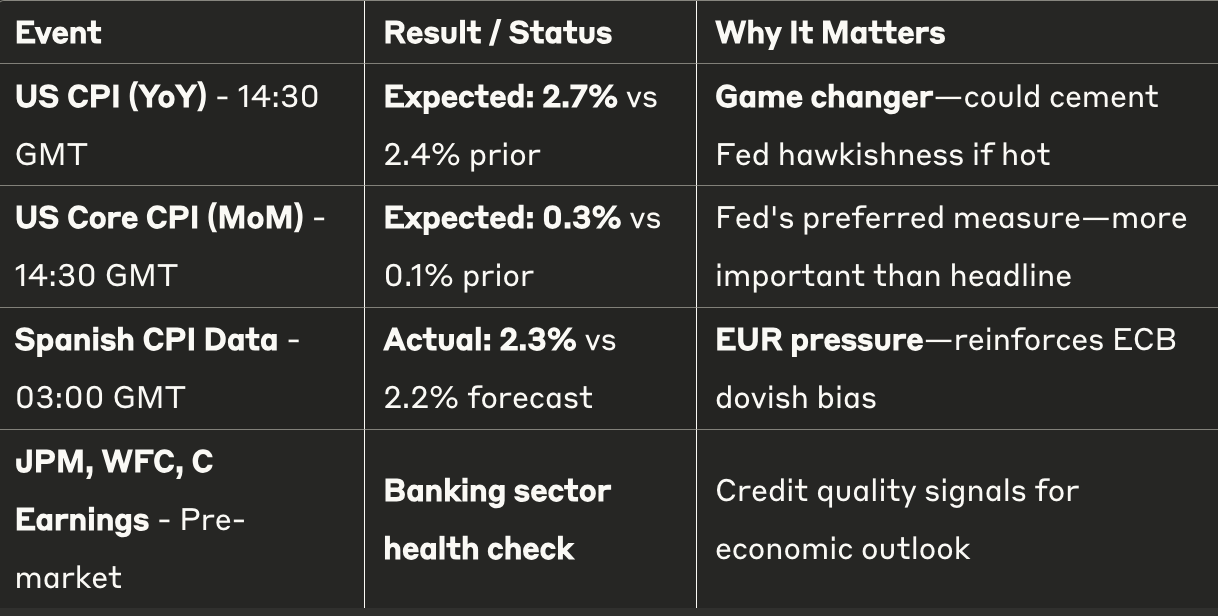

📊 Key Data Roundup

Cross-Asset Angle: Bond yields steady, equities mixed, USD firming—classic "wait and see" positioning before major data.

🗓️ Key Economic Events of Today

High-Impact Watches

Fed Communications - Any jawboning post-CPI could trigger violent moves across all USD pairs

Crude Oil Dynamics - Trump's 50-day Russia ultimatum keeping energy markets on edge

Banking Earnings Guidance - Forward-looking commentary could shift recession probability bets

European Data Flow - Spanish inflation already running hot, ECB credibility at stake

China Chip Trade - Nvidia's H20 resumption signals improving US-China relations

💱 Currency Market At a Glance

💸 Extended Pair-Level Insights

EUR/USD - The Stagnation Trade

Trend Focus: Trapped in 1.1630-1.1700 range, bearish bias building

Macro Theme: ECB dovishness vs Fed hawkishness creating policy divergence chasm

Risk Radar: US CPI surprise could trigger violent breakout in either direction

Invalidation Zone: Break above 1.1720 negates bearish setup

GBP/USD - The False Dawn

Trend Focus: Corrective bounce in established downtrend, sellers lurking

Macro Theme: Bailey's large cut threats undermining Sterling fundamentally

Risk Radar: UK CPI tomorrow could cement BoE dovish pivot

Invalidation Zone: Recovery above 1.3500 changes bearish narrative

USD/JPY - The Intervention Dance

Trend Focus: Testing 147.50-148.00 danger zone, BoJ getting nervous

Macro Theme: Yield differentials driving flows, but political pressure mounting

Risk Radar: Verbal intervention risk increases exponentially above 148.00

Invalidation Zone: Break below 147.00 signals intervention success

AUD/USD - The Resilience Play

Trend Focus: Modest recovery from weekly lows, China optimism helping

Macro Theme: Commodity complex stabilization plus China trade improvements

Risk Radar: US Dollar strength could overwhelm commodity tailwinds

Invalidation Zone: Break below 0.6520 resumes downtrend

💡 Today's Trade Ideas

Trade Idea 1: EUR/USD Short on CPI Spike [1.1650-1.1680]

Keep reading with a 7-day free trial

Subscribe to Forex Daily Brief to keep reading this post and get 7 days of free access to the full post archives.